It would be beneficial to closely watch the company’s financials and market conditions to predict future P/S movements. Semiconductor giant NVIDIA Corporation (NVDA) enjoys a central position in the current Artificial Intelligence (AI) boom by virtue of its Graphics Processing Units (GPUs). Underscoring its market position, NVDA’s revenue of $13.51 billion for the fiscal second quarter topped the $11.22 billion analysts’ estimate, while its adjusted EPS of $2.70 beat the $2.09 estimate.

Everspin Technologies updated its third quarter 2023 earnings guidance on Wednesday, August, 2nd. The company provided earnings per share guidance of $0.01-$0.06 for the period, compared to the consensus earnings per share estimate of $0.06. The company issued revenue guidance of $15.40 million-$16.40 million, compared to the consensus revenue estimate of $15.40 million. Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends.

Given this backdrop, let’s look at the trends of NVDA’s key financial metrics to understand why it could be wise to wait for a better entry point in the stock. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be 3 types of unemployment a better predictor of the future, which can give investors an advantage in earnings season. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. Sram & Mram Group, a UK-based conglomerate, announces INR 2 lakh crore investment in Odisha to set up a semiconductor manufacturing unit at the Make in Odisha (MIO) Conclave, 2022.

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. 1 brokers have issued 1 year price targets for Everspin Technologies’ stock.

Morningstar‘s Stock Analysis MRAM

The company was founded by Saied Tehrani in June 2008 and is headquartered in Chandler, AZ. Other factors and dimensions could be equally, if not more, significant depending on specific circumstances and indicators. In summary, throughout the observed period, NVDA’s stock price generally increased, exhibiting stages of accelerated growth, particularly in May and June 2023. Despite periodic fluctuations and decelerations, the overall trend indicates positive growth. NVDA – Although chip industry behemoth NVIDIA Corp. (NVDA) topped analyst estimates in the last reported quarter, would it be wise to invest in the stock amid a slump in semiconductor sales?

Magneto Resistive RAM (MRAM) Market Trends Across Globally 2023-2030 – Benzinga

Magneto Resistive RAM (MRAM) Market Trends Across Globally 2023-2030.

Posted: Wed, 06 Sep 2023 06:04:42 GMT [source]

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Style is an investment factor that has a meaningful impact on investment risk and returns.

New minor risk – Earnings quality

1 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Everspin Technologies in the last twelve months. The consensus among Wall Street equities research analysts is that investors should “buy” MRAM shares. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

- There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

- Measuring from the first value in October 2020 to the last given data point in July 2023, there is a growth rate of 3.19%.

- Kevin Conley has an approval rating of 79% among the company’s employees.

- This indicates that the company’s short-term liquidity has deteriorated over the evaluated period.

Everspin Technologies’ stock is owned by a variety of institutional and retail investors. Insiders that own company stock include Anuj Aggarwal, Aparna Oka, Darin G Billerbeck, David Schrenk, Geoffrey G Ribar, Michael B Gustafson, Sanjeev Aggarwal, Stephen Socolof and Troy Winslow. (MRAM) raised $46 million in an initial public offering (IPO) on Friday, October 7th 2016. The company issued 3,800,000 shares at a price of $11.00-$13.00 per share.

Does Everspin Technologies (NASDAQ:MRAM) Have A Healthy Balance Sheet?

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

On average, they expect the company’s stock price to reach $12.00 in the next year. This suggests a possible upside of 22.6% from the stock’s current price. View analysts price targets for MRAM or view top-rated stocks among Wall Street analysts.

Key Executive recently sold US$204k worth of stock

The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. As an investor, you want to buy stocks with the highest probability of success. That means https://1investing.in/ you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

- The worldwide sales of semiconductors came in at $124.50 billion for the second quarter of 2023, registering a 17.3% decrease from the second quarter of 2022.

- Please note that there is a marked fluctuation in the latter part of the series, which saw a fall and a notable recovery in the gross margin, illustrating the volatile performance of NVDA in recent years.

- An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

- Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends.

While recent data suggests some volatility, the current trend indicates a sharp recovery from previous lows in the ROIC of NVDA. Measuring from the first value in October 2020 to the last given data point in July 2023, there is a growth rate of 3.19%. Please note that there is a marked fluctuation in the latter part of the series, which saw a fall and a notable recovery in the gross margin, illustrating the volatile performance of NVDA in recent years. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

One share of MRAM stock can currently be purchased for approximately $9.79. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Compare

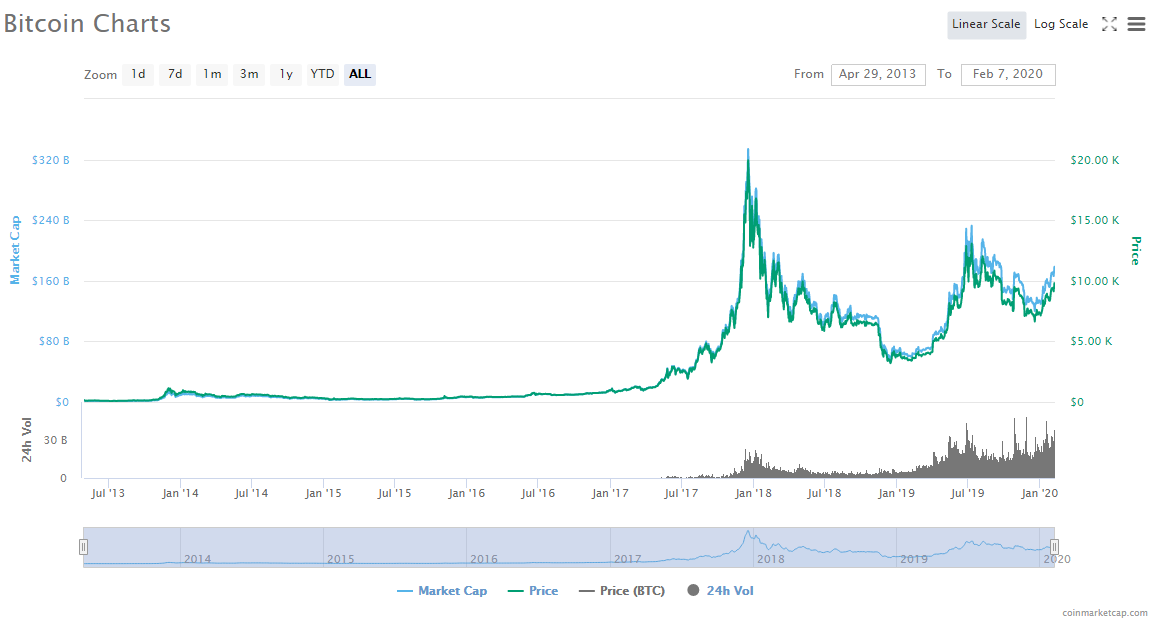

MRAM’s historical performance

against its industry peers and the overall market. Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are Renesas Electronics Corporation (RNECF), Everspin Technologies, Inc. (MRAM), and STMicroelectronics N.V.

Measuring the growth rate from the first value to the last, corresponding to October 2020’s value of 3.92 to July 2023’s value of 2.79, illustrates a decrease of approximately -28.83%. The worldwide sales of semiconductors came in at $124.50 billion for the second quarter of 2023, registering a 17.3% decrease from the second quarter of 2022. Rajvindra Gill, Needhman semiconductor analyst, joins ‘Closing Bell’ to discuss Micron’s warning about production cuts over economic weakness, locating the bottom for smart phone sales and data center…

Everspin Technologies’ stock was trading at $5.56 at the start of the year. Since then, MRAM shares have increased by 76.1% and is now trading at $9.79. NVDA shares were trading at $452.61 per share on Thursday afternoon, down $2.24 (-0.49%). Year-to-date, NVDA has gained 209.82%, versus a 18.63% rise in the benchmark S&P 500 index during the same period. Overall, despite a promising growing trend in 2021, NVDA’s current ratio has experienced a substantial decline from the start of 2022 and into 2023.

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

According to 2 analysts, the average rating for MRAM stock is “Strong Buy.” The 12-month stock price forecast is $11.0, which is an increase of 12.88% from the latest price. Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. Considering the last data point of 0.303 in July 2023 and the first data point of 0.27 in October 2020, there has been a growth rate calculated as approximately 11%.

Style is calculated by combining value and growth scores, which are first individually calculated. Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. This indicates that the company’s short-term liquidity has deteriorated over the evaluated period. It’ll be critical to observe whether this downward trend continues or reverses in subsequent quarters. However, it’s important to note the high levels of volatility within the period.